The long and the short of fintech apps testing

We are all people and care a lot about our money – don’t even argue. When creating financial technology (fintech) apps, companies are mindful of the way we spend and save money and are knocking themselves out trying to make day-to-day used software more reliable, accessible, and simple.

With no surprise, end users are moving their financial activities to mobile. The App Annie’s State of Mobile Report 2020 shows that consumers used finance apps more than 1 trillion times throughout 2019. We cannot deny the role of mobile in the everyday management of our finances starting from mobile banking to payment apps. Smartphones, as well as smartwatches, are literally squeezing out plastic cards from the market, and consumers do not mind.

Fintech businesses aim at delivering products or services driven by innovation. Developers try to streamline user journeys of working with mobile apps. Just adding the features of a finger or facial recognition and contactless payments helps meet consumers’ expectations multifold.

Due to the adoption of AI, ML, RPA, from the end-user perspective, the mobile experience is becoming quite alluring allowing you to forget you are using a fintech app and imagine it is a social media software or a game. In addition, by personalizing communication with customers’, businesses get a raised engagement.

So, we see the power of fintech apps. However, with the financial software complexity, the more force you get, the more responsibility one should take for its development. Complexity – what are we talking about? Financial technology manages, processes, serves, and delivers vital user data that is considered to be private and sensitive (credit card info, social security numbers, etc.).

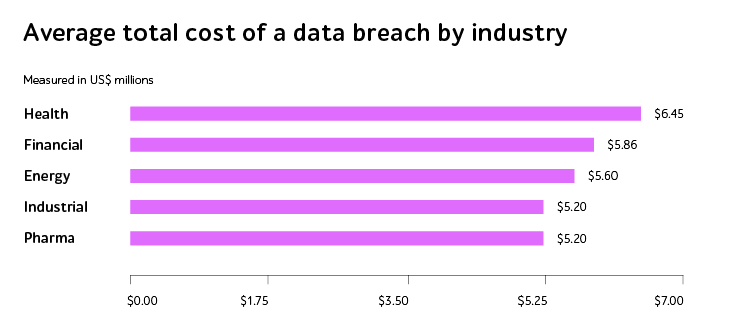

The financial industry, as well as healthcare and government, is a highly regulated environment. Surprisingly, organizations working within such rigorous regulatory requirements have a higher cost of a data breach. With $5,86 mln of average data breach total cost in the financial industry, it is the second highly-measured industry after healthcare ($6,45 mln).

With all that, fintech applications – be it a mobile, web, or other software types – should get special treatment of QA. To know more about quality assurance significance and which testing types we recommend each app to pass through, keep reading.

Quality assurance in fintech: Boiling the ocean

Software defects that are seen and found by users not just irritate them, but scare that their private and financial data is under risk. Also, fintech products are diverse and can entail multiple financial areas like payment systems, lending, mobile banking, investment, and many more.

Therefore, they have to obtain a customer-centric testing strategy, which should take into consideration the following aspects:

- Data confidentiality and security of private and financial info

- Compliance with regulatory issues for financial transactions

- Transactions processing process peculiarities

- Users’ request processing speed

- Multi-level functionalities

- Accessibility to all potential users

- Hard-to-handle complex customers DB

- Multiple variations of used devices for accessing apps

- Possibilities of security threats and breaches

Denis Kulchavy, Director of banking systems testing department at a1qa, provides his opinion:

“While giving significance to QA and software testing, companies can offer their consumers tech-oriented software products tested specifically for the selected target audience. Apart from providing error-free code, the QA engineers can help reduce efforts and budget.

For the customers that are new market-makers, the businesses can increase delivery speed, put in their hands a high-quality software, and get the improved financial experience.”

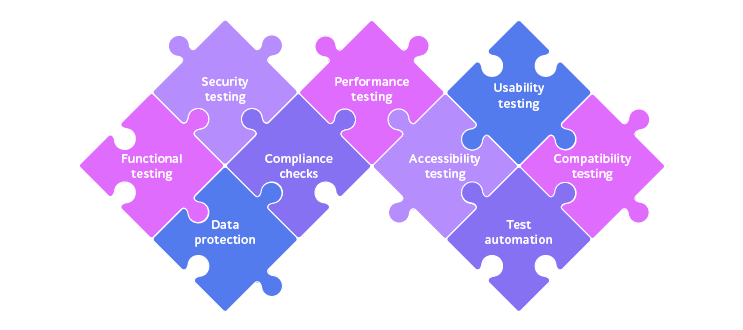

7 testing pillars of a basic fintech application

As with any other software product, financial technology products should pass a range of testing types. Bearing in mind their multi-tier functionality, we will get to the bottom of each check.

1. Functional testing

Testing fintech app functionalities is a huge concern, which differs a lot from classic software testing scenarios, as it includes at least work with financial transactions and sensitive data. A QA engineer should explore the app from inside out and delve really deep in the BFSI area itself. And it is logical to get that ALL possible test cases are to be envisaged covering alleged risks in the features.

To ensure the app meets the requirements, testers are also to assess the level of interactions with other systems and software components.

2. Security testing

This is the ever-evolving issue in fintech app checking while using and storing personal, financial, and banking information of the consumers. Due to third-party payment gateways and money transfers, the system becomes a garlic bread for hackers. Not to let them steal the data, testing veterans conduct pen testing allowing perform the ethical hacking when thinking as a QA engineer but acting as a violator.

This is how it becomes clear how the app reacts to cyberattacks and helps find areas of vulnerabilities or risks.

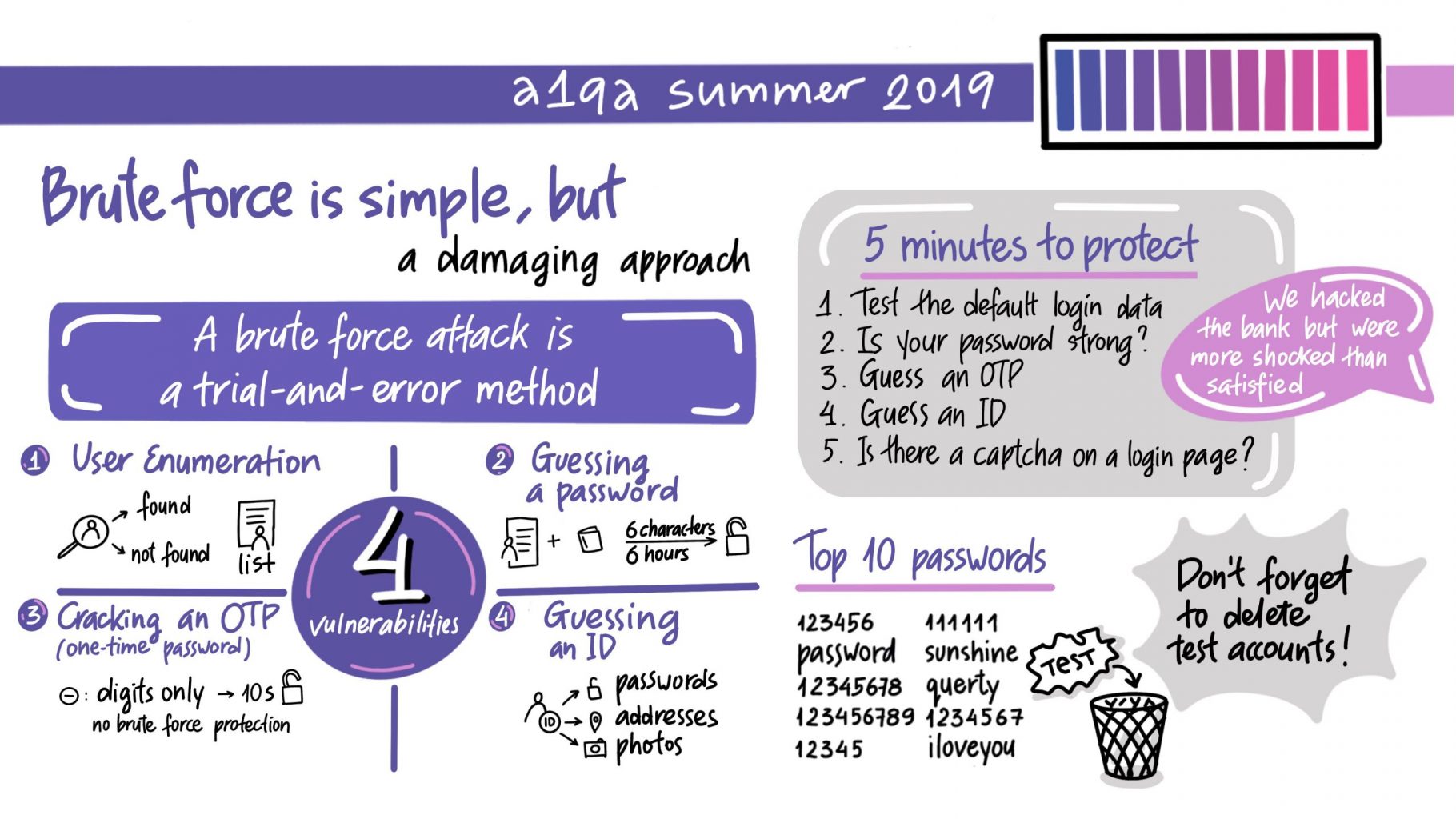

For the 9th a1qa summer professional conference, our security testing specialists prepared a presentation based on the real project. Having worked with the client’s online banking system, the experts have found some critical vulnerabilities connected with brute-force attacks. Have a look at the highlights below.

3. Data protection

Hard to imagine an industry that uses data more frequently than in financial technology. Said so, protection and managing all information is an essential question to be answered.

Databases should be tested for integrity, smooth migration, and quick loading. Creating a realistic set of data requires a holistic approach, as a tester has to always remember about the security of info.

4. Compliance checks

As a well-known fact, financial companies must work with respect to a regulated set of rules depending on the geographical or industry zone. For collecting or processing the European Union’s residents’ data, we talk about GDPR. In the United States, the CCPA (California Consumer Privacy Act) adopts the EU rules for California residents, Gramm–Leach–Bliley Act (GLBA) sets privacy and security requirements, the State data breach notification laws empowers all states to inform customers about security breaches involving personal information.

And compliance testing of a fintech app helps ensure it meets the regulation staying attentive to frequent amendments in legal provisions.

5. Performance testing

For mission-critical applications (and those developed within the financial technology industry are kind of this), load testing should start early within the SDLC. With the shift-left approach, it is more cost-effective to fix the identified software bottlenecks and care a lot about the quality during all development journey.

By stressing the app with a specific expected load, the QA engineers get the results on possible performance impact and can assure that the system can provide the necessary speed for processing user requests.

The challenge of load testing – setting up a fintech environment – can be easily solved through the implementation of the appropriate toolset, which can help enter high-security parts of the infrastructure.

6. Accessibility testing

While assuring the quality of the fintech app, the QA specialist will make sure that the software cares about the needs of people with disabilities (including visual, cognitive, auditory, or physical impairments) and allows their alternative access to your app.

7. Test automation

Automated testing helps pass the exhaustive testing process full of repetitive tasks faster by eliminating manual checking of user flows and scenarios. With forward-looking test automation approach and the right tools, more critical bugs can be found before go-live to provide quality at speed.

These are the main testing types that are to be included in the testing strategy while working with financial technology software. It is also important to conduct regression testing to ascertain that any changes enhancing user experience haven’t damaged the security, accuracy, compliance, and other issues and wisely automate it as much as possible.

Along with that, checking the usability for boosting user experience and ensuring rigorous compatibility with different OSs and environments are important too.

Summing up

Over the years, we have seen technology hitting almost every industry, and BSFI is not the exception. Thanks to consumers, financial and other companies try to cater to them applications that can ease their lives.

Financial technology software will always be in dire need of quality assurance helping launch a bug-free and highly competitive product.

Software testing leverages its force to find the mistakes, their causes, and ascertain they are fixed before hundreds or thousands or more end users have started to work with the system processing and serving sensitive data. To get confident in the fintech app’s quality and readiness for showing the world, write us a note to get a consultation on QA-related problems.